Os EUA, que mesmo com a eclosão da Segunda Guerra Mundial com a declaração de guerra da Inglaterra e da França à Alemanha em 3 de setembro de 1939 estavam neutros, com o bombardeio japonês à base naval americana no Havaí declararam guerra ao que ficou chamado Eixo, o alinhamento da Alemanha à Itália e ao Japão. Poderia haver algum atentado a Roosevelt.

Information about the entire collection of autos in the world. thanks hopefully useful do not forget to come back :)

Thursday 31 October 2013

CARRO DE GÂNGSTER...PARA O PRESIDENTE ROOSEVELT

Os EUA, que mesmo com a eclosão da Segunda Guerra Mundial com a declaração de guerra da Inglaterra e da França à Alemanha em 3 de setembro de 1939 estavam neutros, com o bombardeio japonês à base naval americana no Havaí declararam guerra ao que ficou chamado Eixo, o alinhamento da Alemanha à Itália e ao Japão. Poderia haver algum atentado a Roosevelt.

Jay Alix Now Takes Credit for GM Bailout

Editor’s Note: Lots of people–including President Obama–have trumpeted their role in the success of the government-backed turnaround plan that saved General Motors, the most important industrial company in the history of the United States. But on the fifth anniversary of the crisis, Forbes presents an exclusive, unprecedented look at what really happened during GM’s darkest days, how a tiny band of corporate outsiders and turnaround experts convened in Detroit and hatched a radical plan that ultimately set the foundation for the salvation of the company.

Author Jay Alix, one of the most respected experts on corporate bankruptcy in America, was the architect of that plan, and now, for the first time, he reveals How General Motors Was Really Saved.

Ruggles Writes: Alix IS highly respected, or at least he has been. The country of Japan once paid him huge dollars to analyze their own economic system. But I am reading this article with a grain of sale. It seems to me to be somewhat self serving for a Johnny Come Lately to come in 5 years after the fact to take a large measure of credit. I'll try to follow up this post with documentation either for or against.

Steve Rattner mentions Alix Partners only once, on page 197 of his book "Overhaul." Regarding resentment of Team Auto's bankruptcy specialist Harry Wilson, who rubbed many at GM the wrong way, Rattner writes in the book:

"To hear Harry and his even younger aides imply that the company was slow, inept, and out of date was insulting, to put it mildly. "Who does this little prick think he is?" they would sometimes mutter after a meeting with Harry. But not everyone connected with GM responded this way. Longtime advisers from such firms as Morgan Stanley, Alix Partners, and Evercore generally nodded in agreement with Team Auto's requests and "prescriptions," which often echoed their own past recomendations to their reluctant client."

I had been told by numerous sources that Wagoner threatened to fire any GM employee who even whispered the word bankruptcy. Here's Alix saying the Section 363 sales was his idea, presented to Wagoner on December 8, 2008, days before the Bush Administration extended the bridge loans that allowed GM to survive until the Obama Administration came in to inherit the mess. It IS clear, however, that there had been many steps taken by Wagoner and his executive team leading up to the bankruptcy that helped facilitate the unprecedented 40 day walk through Chapter 11 bankruptcy court. Regardless, after presiding over about $80 billion in losses, Wagoner left GM in March 2009 with a substantial "Golden Parachute." Sources differ on whether he was fired by the President, Larry Summers, or Steve Rattner, or just offered to step down and had his offer accepted. His record at GM was mixed at best.

Forbes: October 2013

By Jay Alix

....

In the popular version of the company’s turnaround story, as GM teetered toward liquidation in 2009, an Obama-appointed SWAT team, led by financier Steven Rattner, swept in and hatched a radical plan: Through a novel use of the bankruptcy code they would save the company by segregating and spinning out its valuable assets, while Washington furnished billions in taxpayer funds to make sure the company was viable.

...

GM’s extraordinary turnaround began long before Wagoner went to Washington in search of a massive loan to keep GM alive. My involvement in that story began in GM’s darkest days, five years ago on Sunday, Nov. 23, 2008, when I visited Wagoner at his home....

“Filing bankruptcy may be inevitable, Rick. But it doesn’t have to be a company-killing bankruptcy,” I said. “I think we can create a unique strategy that allows GM to survive bankruptcy.” .... I proposed that GM split into two very separate parts before filing: “NewCo,” a new company with a clean balance sheet, taking on GM’s best brands and operations; and “OldCo,” the leftover GM with most of the liabilities. ...we would use Bankruptcy Code Section 363, which allows a company to sell assets under a court-approved sale. Typically, 363 is used to sell specific assets, from a chair and desk to a factory or division, but not the entire stand-alone company. Under this strategy GM could postpone filing a plan of reorganization and a disclosure statement, which consume months and fuel a blizzard of litigation while market share and enterprise value bleed away.

... I volunteered to help GM on a pro bono basis. But what I could never anticipate was how deep and strong the opposition to my plan would ultimately be.

On Tuesday, Dec. 2, I pulled into GM’s Detroit headquarters at 7 a.m. after most of the company’s executives had already arrived for work. I was given a small cubicle and conference room on the 38th floor, a spacious but empty place that held GM’s corporate boardroom and a warren of cubicles reserved for visiting executives and board members.

Spending 18 hours a day digging through the numbers in GM’s filings, I began working in greater detail on the outlines of the plan and making some assumptions on what assets should be transferred to NewCo and what would stay in OldCo, which I dubbed Motors Liquidation. There were thousands of crucial questions that had to be asked and answered with management: Which brands and factories would survive? Which ones would the company have to give up? What would be the endgame strategy? What would be the enterprise value of NewCo? The liquidation value of OldCo?

...three alternative plans. First, they hoped to avoid bankruptcy altogether, believing the government would provide enough funding to bring GM through the crisis. At least two cabinet members in the Bush Administration and others had provided assurances to Rick and board members that government help would be forthcoming.

Second was a “prepackaged” bankruptcy plan being developed by general counsel Robert Osborne with Harvey R. Miller, the dean of the bankruptcy bar and senior partner at Weil, Gotshal & Manges. Under this plan, GM would prepare a reorganization in cooperation with its bond creditors that would take effect once the company went into a Chapter 11 bankruptcy. The goal of a so-called prepack is to shorten and simplify the bankruptcy process....

And third was the NewCo plan, based on years of experience at AlixPartners, where we had a major role in 50 of the 180 largest bankruptcies over $1 billion in the past 15 years. GM had also retained Martin Bienenstock, the restructuring and corporate governance leader from Dewey & LeBoeuf, to help develop the NewCo plan as well....

From my perspective Wagoner had been unfairly treated by many politicians and the media. Since taking over as CEO in 2000, working closely with Fritz and vice chairman Bob Lutz, Rick orchestrated large, dramatic changes at the company. They closed GM’s quality, productivity and fuel-economy gaps with the world’s best automakers, winning numerous car and truck awards. They built a highly profitable business in China, the world’s biggest potential car market. They reduced the company’s workforce by 143,000 employees, to 243,000. They reached a historic agreement with the UAW that cut in half hourly pay for new employees and significantly scaled back the traditional retiree benefit packages that had been crippling the company, while also funding over $100 billion in unfunded retiree obligations. And he was able to accomplish all these changes without causing massive disruptions among GM’s dealers or major strikes with the unions.

Ultimately, those structural changes positioned the company not only to survive but also to bring about the extraordinary turnaround. But now, with the economy and the company in free fall, all of that hard work seemed to be forgotten.

....

“Rick, do not resign ... until we get the three things...

“We have to get government funding of $40 billion to $50 billion. Plus, we need an agreement with the government and GM’s board to do the NewCo plan. And we must put a qualified successor in place. It must be Fritz and not some government guy. It’s going to be painful for you, but you’ve got to stay on the horse until we get all three.”

When we gathered for a telephonic board meeting on Dec. 15, the mood was urgent, the tension high. Only two weeks after arriving at GM I was about to present the plan to the board of directors in a conference room outside Wagoner’s office. Also on the phone were the company’s lawyers and investment bankers.

... we were just two weeks away from running out of cash.

Miller [and] ... Other attorneys chimed in, claiming the plan oversimplified the situation and there would be major problems with it. Yet another added that this would not be viewed well by the court and doubted any judge would allow it. Collectively, they characterized it as a long shot, discouraging the directors .... Unbeknownst to me [inside counsel] had previously proposed the idea to GM’s board, naively believing GM could complete a prepack bankruptcy in 30 days....

... Kent Kresa, the former CEO of Northrop Grumman and a GM board member since 2003 [spoke:]

“I understand this has some risk attached to it, but we’re in a very risky state right now,” he said. “And I understand it may even be unusual and unprecedented. But it’s certainly creative, and quite frankly, it’s the most innovative idea we’ve heard so far that has real potential in it. I think it deserves further consideration and development.”

Rick then addressed another lawyer on the call, Martin Bienenstock.

“Well, I’ve actually studied the problem, too, and there’s a way for this to work,” said Bienenstock. “Almost all bankruptcies are unique and the Code does allow for the transfer of assets. I can’t imagine a judge taking on this problem and not wanting to solve it. We’ve done a preliminary analysis, and it’s not as crazy as it sounds. It’s unique and compelling.”

“Okay, we’ve heard both sides of it,” Rick said after others spoke, smartly bringing the debate to a reasonable close. “I suggest we continue working to develop both the prepack plan and the NewCo option, while seeking the funding to avoid Chapter 11 if at all possible.”

The meeting adjourned without a vote....the next weeks I worked closely with Bienenstock, assistant general counsel Mike Millikin, Al Koch of AlixPartners and GM senior vice president John Smith on the NewCo plan. We huddled dozens of times with Wagoner and Henderson to work out which brands GM would ultimately have to give up (Hummer, Saturn, Saab and Pontiac) and which ones it would keep (Chevrolet, Cadillac, GMC and Buick). Informed debate and deep analysis of structural costs led to decisions about projects, factories, brands and countries.

On Sunday afternoon, Mar. 29, Wagoner called me. It was a call I had hoped would never come–but here it was. ...

Wagoner told me Henderson would be named CEO. “What about the bankruptcy?” I asked. “They’re enamored with the 363 NewCo plan. They seem bound and determined to make us file Chapter 11 and do NewCo. … This is really tough,” he said.

“I’m so sorry,” I said, pausing, “but … you got the money. They’re doing the NewCo plan, and Fritz is your successor. … You’ve succeeded. You got the three things.” ....

.... The strategy I pitched to Wagoner in his living room four and a half months earlier was the plan chosen by Team Auto in a meeting on Apr. 3, 2009 in Washington. Treasury agreed to fully fund NewCo with equity, and thus it became the chosen path to save the company.

[...and more on subsequent events]

Mike Smitka: As per Ruggles, this is fascinating, though as Ruggles points out none of the various insider accounts mention Alix as the source of the idea, though (I checked) contemporary news accounts do credit him and the others he mentions as outside advisors to GM. My suspicion is that the Task Force had staff who independently considered §363 – a quick news database search found lots of references in fall 2008 to §363 bankruptcies of this sort, including a panel at a bankruptcy lawyer conference labeling it a "hot topic". Similarly, on 20 February 2009 the WSJ blog [Deal Journal] posted of a Heidi N Moore interview with Mark Roe of Harvard Law School suggesting it as the obvious approach. In any case, both their performance in public and Rattner's account of interactions in private cast doubt on the ability of GM's finance operation to pull together details, and the sub-text I read in the Alix story is that until the very end GM's board remained fixated on unrealistic scenarios. Alix however focuses on Wagoner and does not point out that most of the board was replaced. But the latter deserves a post of its own, moribund boards of moribund companies. Chrysler under Iaccoca, GM under Roger Smith, Nissan for the 20 years prior to its acquisition by Renault...there are all too many examples.

Wednesday 30 October 2013

PLACAS DE SINALIZAÇÃO NAS ESTRADAS INDIANAS

Foi o leitor e meu grande amigo Luiz Leitão que mandou a foto acima e as que seguem. Foram publicadas no jornal inglês The Guardian e são de autoria do fotógrafo indiano Ajay Jain, de Nova Déli, que fez mais de 400 fotos durante os quase 10 mil quilômetros em estradas da Índia na região dos Himalaias. A foto acima diz: "Um gato tem nove vidas mas aquele que dirige não".

Boa parte delas são trocadilhos, só têm sentido na língua original, mas assim mesmo dá para divertir. Veja o resto:

|

| "Depois de beber uísque, dirigir é arriscado" |

| ||

| "Melhor ser sr. Atrasado que o falecido sr." |

CONTINUE LENDO >>>

Tuesday 29 October 2013

TECNOLOGIA HYBRID AIR, SOLUÇÃO DA PSA PARA HIBRIDIZAÇÃO

|

| Chassi rolante do conceito Hybrid Air |

Monday 28 October 2013

TROMBOS

"São Paulo vai parar"; "As ruas não comportam mais tanto automóvel"; "As pessoas têm de deixar o carro em casa": é o refrão de "especialistas" em trânsito ou, termo da moda, "mobilidade urbana". Mas, espere, o editor não terá colocado imagem errada para começar o post? Pelo texto, o assunto parece ser trânsito, não anatomia humana!

Sunday 27 October 2013

DE CORRIDAS. O TUFÃO, O TALA E O DEFEITO ZOOLÓGICO. HISTÓRIA? ESTÓRIA?

|

| Simca (centro) fatura por dentro um DKW (esq.) e Renault Gordinis atrás (foto Luiz Cláudio Nasser) |

Saturday 26 October 2013

Transparency and the Retail Auto Business

The new buzz word in the Auto Industry these days is “Transparency.” Auto manufacturers have fallen in love with the word, as have vendors looking to charge Dealers money to bring "Transparency" to their customers. To some, the word is euphemism for “One Price,” where every buyer pays the same profit margin. This has been proven to be an abject failure. The demise of the Ford Collection is the prime example. We could revisit the Saturn debacle, but why? How many times does the lesson have to be learned. Does anyone actually think Saturn was a success story?

There are still Dealers using “One Price” as a strategy of Negotiation, but “One Price” ONLY works when there is more demand than supply. Most Dealer’s fantasy is to wake up one day and find out that his nearest competitors have all gone to a “One Price” strategy.

To many consumers, "Transparency" means being able to bypass the dealer and buy direct from the manufacturer so everyone pays the same margin and there is no middle man profit. After all, they aren't aware there really is no middle man profit, on average, after payment of middle man expenses. For some reason, they are oblivious to the fact that those expenses still exist if the factory owns the car dealership.

Ever notice how it is the Silicon Valley types who want to change our business? Ever notice that they have never sold cars on commission or owned a Dealership before they set out to give Consumers what they think they want. These people are experts at running focus groups, although they don’t know the right questions to ask or how to interpret Consumer answers.

So lets set out to thoroughly discuss the issue of “Transparency” as it regards the Car Business.

“In economics, a market is transparent if much is known by many about:

- What products, services or capital assets are available.

- What price.

- Where.

There are two types of price transparency: 1) I know what price will be charged to me, and 2) I know what price will be charged to you. The two types of price transparency have different implications for differential pricing.

A high degree of market transparency can result in disintermediation due to the buyer's increased knowledge of supply pricing.

In economics, disintermediation is the removal of intermediaries in a supply chain, or "cutting out the middleman". Instead of going through traditional distribution channels, which had some type of intermediate (such as a distributor, wholesaler, broker, or agent), companies may now deal with every customer directly, for example via the Internet. One important factor is a drop in the cost of servicing customers directly.

This can also happen in other industries where distributors or resellers operate and the manufacturer wants to increase profit margins, therefore eliminating intermediaries to increase their margins. (In the case of the Auto Industry, the “intermediaries would the franchised new vehicle Dealers.)

“Disintermediation” initiated by consumers is often the result of high market transparency, in that buyers are aware of supply prices direct from the manufacturer. Buyers bypass the middlemen (wholesalers and retailers) to buy directly from the manufacturer, and pay less. (Buyers can also pay MORE because the manufacturer controls the market. Competition between Dealers is what maintains the price equilibrium Consumers aren’t smart or knowledgeable enough to appreciate.)

Price transparency can, however, lead to higher prices, if it makes sellers reluctant to give steep discounts to certain buyers, or if it facilitates collusion.” Excerpts from WIKI

In legal terms, and in the context of the Auto Business, “Transparency” means fully disclosing all information mandated by all applicable laws in exactly the way the law demands these disclosures take place. There is NO legal mandate that the Consumer has to be happy with the transaction. We have always known that a “Good Deal” is largely a state of mind.]

Definition of “NEGOTIATE,” Merriam Webster:

- to confer with another so as to arrive at the settlement of some matter.

- to deal with (some matter or affair that requires ability for its successful handling):

- manage to arrange for or bring about through conference, discussion, and compromise “

A brief historical reference of Transparency Regulation in the context of the Auto Business:

New vehicles did NOT have a stated and posted price until 1958, when a law sponsored by Senator Mike Monroney of Oklahoma was passed. Trucks did not have a priced Monroney label until much later. “The window sticker was named after Almer Stillwell "Mike" Monroney, United States Senator from Oklahoma. Monroney sponsored the Automobile Information Disclosure Act of 1958, which mandated disclosure of information on new automobiles.”

Even if the Consumer is prepared to pay the Auto Dealer’s asking price, the value of any trade in has always been a matter for Negotiation. There is no single wholesale value for any Pre-Owned vehicle. A vehicle is worth whatever a wholesale Buyer will pay at auction in a competitive bid situation on a given day. Typically, Retail Buyer’s want Retail for their trade, thinking the Dealer should sell their trade at Retail just to get their money back, for the privilege of selling a new vehicle.

Even in the most simple purchase situations, where a Dealer states his/her price and the Buyer accepts and makes the purchase, this is still technically a “Negotiation.” The stating of a price is a first pass of Negotiation. Regulation, beginning with the government mandated Monroney label, has forced Dealers to state their price instead of merely entertaining offers on sales. The Monroney law came into being after WW II, when Auto Dealers, who hadn’t had new vehicles to sell for years, were in a short supply, low demand situation. And they took advantage. After all, they had just been through a period of no supply and high demand and had previously experienced high supply and low demand during the Great Depression. Consumers were offended, preferring only to experience a market driven by higher supply than demand.

As a practical matter, it makes no sense for a Dealer to debate “transparency” with Consumers OR with those who have never had the experience of making a livelihood by selling vehicles or with those with a major investment in an Auto Dealership. They have no standing on the issue. In the Auto Business it becomes clear quickly that without substantial gross profit, one doesn’t eat very well. The Sales Person’s welfare or the Dealer making a profit are NOT concerns of most Consumers. Consumers typically have no understanding of what a Dealer’s Cost of Sales might be. They don’t typically care. But for some reason many Consumers think they have the right to know a Dealer’s cost structure. These same Consumers seldom ask cost and margin questions of other retailers. At the least they don’t want to pay more than other Buyers of the same product. That’s no surprise. Neither do I. But if I buy from a “One Price” Dealer there is NO ASSURANCE that others aren’t buying for less than I do. After all, there are always competitive Dealers who are happy to work from their “One Price” competitor’s Best Price.

All car buyers negotiate in some fashion and to some degree. Car buyers typically think they are entitled to be quoted a price to take to competitive Auto Dealers. The first Dealer either accommodates, or doesn’t. If the Buyer doesn’t like a Dealer’s Negotiation Strategy, they are free to find one that gives them what they want. In other words, the market works in the Buyer’s favor. The Car Buyer can find another Dealer more quickly than the Dealer can find another Buyer. Consumers are NOT held to the same laws and ethics that Dealers are obligated to. So the Consumer holds all of the advantages, EXCEPT, in most cases, the Dealer has more experience Negotiating car deals and possesses more accurate information. Providing equal information to a Car Buyer would, in theory, create an efficient market that could commoditize new vehicles. This could theoretically eliminate Dealers. But then who would take the trades? Who would arrange the financing? And who would teach Consumers how to interpret all of the information?

In Business, it is also clear that if a Negotiation takes place, and neither party gets their “feathers ruffled,” someone left money on the table.

So what do Car Buyers really want? They want a guarantee that they will WIN the Negotiation. They want a guarantee that the Dealer will quote them a price that they can validate in their own mind by using what the first Dealer provided to shop other competitive Dealers. This has not changed in my 43 years in the Auto Business. Only the method of delivery of the information has changed, as well as they ease with which a Consumer can shop. If a Dealer doesn’t play along, they are vilified, not only by Consumers, but OFTEN by 3rd Party Vendors who appeal to Consumers and who also depend on Auto Dealers for revenue. But the Market works. If Consumers are unhappy with one Dealer, they can go to the next. They can also make use of information provided by the Vendors, although these Vendors are at risk if they also depend on Dealers for revenue.

As it involves the varying definitions of “Negotiation,” many Car Buyers would prefer to have the Dealer disclose the triple net cost of their product, and then “Negotiate” the “Margin.”

So how does one sell New Vehicles in this environment? Most Dealers attempt to provide Consumers with a “Perception of Transparency” as a Negotiating strategy, since TRUE Transparency would prevent making a Gross Profit high enough to pay overhead expenses. We currently do not have true Transparency and we are still seeing considerable margin compression.

The Consumer has the ability to shop until they find an Auto Dealer Negotiation strategy they like. Some give up and buy because they were worn down, lost patience, and gave in. Others depend on the Dealer to arrange financing which may be more important to them than the price of the vehicle.

Despite the massive amount of regulation that has been imposed on the Retail Auto Business, the current Market Driven system has sold up to 17 million vehicles in a year. Some might say the system has served us well over the years despite the fact that many Consumers are aggravated by the process. To those Consumers, I say, “Keep shopping until you find the Dealership shopping experience that gives you what you want.” Let the Market work.

Dealers are not typically completely “Transparent” with their own Sales People and Managers. Why should they be? It is human nature for Sellers to give away potential profit in an effort to make a sale. The cost structure of a new vehicle is so complicated that even Dealership management staff has a hard time understanding it. In many cases, the true cost structure is not determined until a Dealer receives a check based on the achievement of objective over a period of months. With all of the possible incentives, including “Conquest Incentives, “Realator Incentives, Plumber Incentives, Glass Company Incentives, First Time Buyer Incentives, Fleet Incentives, Special Bid Incentives, College Grad Incentives, Employee Purchases, various “Private Offers,” Returned Military Incentives, and many more, plus variations of the above. Trying to provide all of this information, including teaching Consumers the elements of the wholesale market would be overwhelming to most. It would be akin to drinking from a fire hose. There is a considerable learning curve when training new Sales People. Consumers aren’t typically going to understand it all when they are only buying a vehicle every few years.

New hires entering the Auto Business as Sales People bring their perceptions as a Consumer to their new job. Like me 43 years ago, most were convinced in the beginning that selling cars would be easy. All one would have to do is to quote the lowest price and make up the loss of margin in additional volume. What a revelation us veterans of the business had when we found out that Consumers had no loyalty. There has never been such a thing as the “best price,” despite the fact that Consumers typically think there is. As an early “price quoter” I was the one who spent the time, gave a detailed product presentation and demo drive, only to find many of my prospects, who had promised to “Be Back,” had bought from a competitor who had beaten my “Best Price” by a small margin. Occasionally, deals are lost because one appraiser might see more value in a trade in than another.

To be clear, some Auto Dealer attempts at negotiation are more “artful” than others, and crude attempts at Negotiation generally fail. The Consumer isn’t harmed, except for some wasted time. They are certainly given “grist for the mill” in their complaints about “Negotiation.” They are free to keep shopping for that Dealer who gives them what they seek. But then some Consumers are never satisfied.

I recall a time when my boss, the Dealer himself, quoted me a price that involved a $1K mistake in my Customer’s favor. I presented this price to my Customer who then railed about us being crooks, cheats, and liars. After shopping our quoted price the Customer later slunk back into our Dealership to take try to take advantage of the mistaken quote. And because we didn’t honor the price from two days earlier, we were crooks, cheats, and robbers all over again. A good deal is as much perception as reality.

Let’s discuss “Transparency” as a practical matter in the modern Internet driven Auto Market. The most demanding Consumers are the ones who have 720 and higher credit scores. They know they have good credit and can buy what they want. They are the ones who are most analytical and the most demanding of information to shop with. They are the ones who feel most entitled to be able to determine the “Best Price” from the convenience of their office chair using the Internet, entertain competitive quotes from Dealers all vying for their business, and to make a purchase decision without spending a lot of time or going through a more traditional process of negotiation. They will typically visit a dealership for a demo drive and to gather additional information, then retreat to their computer to use the Internet to “Negotiate” the price as they try, often successfully, to get Dealers into a bidding war with each other. The fact is, this niche of Buyers make a LOT MORE NOISE than their numbers would indicate. This group makes up LESS THAN 30% of Consumers. And of that 30%, at least 5% of those have a debt payment to income ratio that does NOT guarantee them financing. All other Car Buyers have a legitimate concern that they might not gain credit approval for a Car Loan at optimum terms and interest rates. AND without the help of Dealers and their market power, many of these could NOT gain a car loan on their own. Does anyone with common sense believe that the Retail Auto Industry should turn itself upside down over 25% percent of Consumers who represent less than 15% of total Vehicle Sales Gross Profit?

In this current environment Manufacturers are coercing Dealers into ever higher overheads through ridiculous “Image Programs.” What happens if margin compression makes the selling of vehicles unprofitable to Auto Dealers? A quick look at history will give an indication. When I entered the auto business in 1970, the Markup on large vehicles was 22.5 percent, plus a 2 – 2.5% “Hold Back” that was paid to the Dealer every quarter or at year end. Imports typically had no “Hold Back” in those days. Deals were transacted OVER “Invoice,” the amount the Manufacturer drafts the Dealer’s floor plan account when the vehicle leaves the assembly plant, sometimes before. There was little “Trunk Money,” money rebated to the dealer based on “Stair Step” programs and other incentives based on achievement of an assigned objective. In other words, “Invoice” had meaning. Today “Invoice” has little meaning. Consumers routinely take delivery of a new vehicle for LESS than the Dealer has to pay off at his/her lender. The “Markup over invoice today is less than 10%. Manufacturers have raised the MSRP to accommodate both the cost of rebates and subventions, but also the “Trunk Money.” In 1970 F&I revenue represented a relatively small portion of Gross Profit on a per deal basis. Today the per deal F&I gross profit runs from $1K to $1.5K. Labor rates in Dealer Service Departments were reasonable in 1970. Today, $100. plus per flat rate hour isn’t unusual. Are you starting to get it now?

Many Consumers think Manufacturers should cut their Franchise Dealers out of the equation. First, there are laws in place to protect those Dealers, all of whom have made substantial investments in their businesses. Secondly, the OEMs would need Ben Bernanke's printing presses running full time to ever come up with the amount of capital required to replace their Dealers. It ain't gonna happen.

The Bottom Line:

- Consumers already have the market slanted in their favor

- Consumers can readily shop

- If Consumers don’t want to “Haggle,” let them find a Dealer who will give them what they want.

- Vendors who started their businesses depending on dealers for their initial revenue, and who now turn on those dealers and demonize them in an effort to convince consumers to turn to them for “protection” from the villains, and who provide even more downward pressure on gross profits, can expect push back and a lack of cooperation from auto dealers.

TrueCar, CarFax, Cars.com, and some others have paid a price for pushing Dealers too far by providing Consumers additional tools to help them in the effort to compress margins, often depending on Dealers to support their efforts. These Companies have every right to do what they are doing and/or have done, but they are unrealistic if they expect there to be no push back from Dealers. I suspect there are some others, including Kelly Blue Book and their version of the “Bell Curve, recently abandoned by TrueCar while under fire from Dealers, who will be a target for Dealer push back.

As long as the Franchise Dealer system is in place, trades are taken, and financing not a given, there will be no completely “Transparent” and “Efficient Market” that commoditizes pricing in the Retail New Vehicle Business. Is this a surprise, or just common sense? The current system has served us well and will continue to do so.

At the recent JD Power/NADA conference held in March in New York City, noted Auto Industry analyst Maryann Keller spoke optimistically about the conventional system of selling cars in the U.S. “Over four decades, I’ve heard many arguments made against the Franchise Dealer system.” They are claims Dealers never fail to disprove time and time again.”

One myth promulgated in the 1990s, and now resurfacing with Tesla’s effort to run its own sales outlets, is that factory stores save money by reducing distribution expenses, wrongly estimated at 30% of the total cost of a car.

Put aside for a moment that the percentage itself is way off, Keller says. Ford’s ill-fated Auto Collection experiment in certain markets during the late 1990s proved that Auto Companies are good at a lot of things. Running Dealerships isn’t among them. Dealers with entrepreneurial spirit are good at doing that.

Ford ended its bad-science experiment after a couple of years of market share losses and mounting evidence that Factory Stores do not deliver a better customer experience nor reduce costs.

Franchise dealers’ cumulative investment in land, equipment and facilities easily exceeds $100 million, Keller says.

“Dealers fund 60 days of inventory and another month of inventory in transit that would otherwise fall to the Auto Maker.”

The inventory buffer allows auto makers to adjust future production levels. For a company like Ford, U.S. inventory funding equals about $15 billion at any point.

“While we are talking about myths, how about the still-repeated one that people hate Dealers so, if given the chance, they will buy a car online,” Keller says. “I almost don’t know where to start in taking this one apart.”

Not all that long ago, Silicon Valley funded and lost hundreds of millions, maybe even a billion dollars, on ill-fated ventures that promised to sell cars online.

“CarOrder.com, Greenlight.com, and CarsDirect.com (in its original configuration), among others, all promised to avoid the dealership experience,” Keller says. “A few actually did that by buying cars from Dealers, and then reselling them at lower prices to customers until they blew through their capital.”

She recalls the defunct Build to Order.com. It proposed that customers would place orders for fully customized cars while lounging in a company-owned showroom/entertainment center. “Build-to-order.com never built anything for anyone,” Keller says. Priceline.com’s experiment of trying to sell cars online was in some respects replicated later by TrueCar.com, which ran afoul of franchise laws for the same reasons Priceline

“What I learned then, and this is still true today, is that we could connect Buyers with Dealers and that the price of a vehicle was the easiest part of a deal,” Keller says. “The other elements are harder to control and often the cause of frustration for the Customer and the Dealer. People don’t like to hear that their trade isn’t worth the value they saw online or that their poor credit doesn’t qualify them for the no-down-payment, 0% loan.”

Buying a car is as complex as buying a house, Keller says. “Why should we think it should be as easy as buying a pair of shoes from Zappos with a return receipt in the box in case they don’t fit?” While much Auto Advertising has shifted from newspapers to the Internet, that transition “has not reduced Advertising expense per vehicle or made buying a car as easy as buying a book,” she says.

Another salient Keller point:

“Add up all the monthly traffic to all automotive sites, including auto makers, dealers and independent sites, and you’d get more than 100 million, possibly close to 200 million, unique visitors using the Web to get information about buying or selling a new or used car.

Except there’s one problem, if this traffic is somehow supposed to represent potential sales.” Dealers retail about two million new and used cars a month. That’s a fraction of all those automotive website visitors.”

“So just like newspaper, radio or TV advertising, Dealer spend on the Internet is likely no better targeted, once again dispelling the notion that the Internet would solve the age-old problem of knowing which 50% of a dealer’s advertising works.”

Technology is wonderful. Dealers have adapted to it. Sophisticated software helps them manage every aspect of their business. But it will not fundamentally change Auto Retailing, Keller says.

“The system of Franchised Dealers – using their own risk capital to fund their businesses and guarantee millions of dollars of inventory, promote their own brand and that of their OEM, provide the expensive tools needed in their service departments, and manage the endless headache of a workforce – will not be superseded by technology or Factory Owned Mall Stores.”

Keller predicts start ups such as Tesla, which currently runs factory-owned mall stores, ultimately will conclude “the dealer network is the best way.”

I would only add this. As long as Auto Makers understand that Dealers are their Customers and the End User is the Dealer’s Customer, things will be fine.

david ruggles

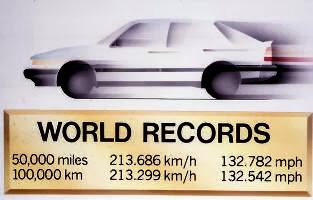

SAAB 9000: 100.000 km A MAIS DE 210 km/h EM 1986

A altura do carro havia sido reduzidaem 45 mm, equipado com defletor inferior dianteiro, relação de diferencial modificada e pneus Pirelli com menor resistência ao rolamento. Essa diferença ao rolamento foi medidaa 250 km/h como sendo de 13 cv contra 27 cv com pneus normais. O coeficiente de arrasto (Cx) foi medido como impressionantemente baixo0,285.

Eu (Olle Granlund, engenheiro-chefe na área de trem de força da Saab Automobile) visitei o Salão de Frankfurt para participar do lançamento do Saab 9000 com motor de 16 válvulase vi o Mercedes recordistaem seu estande. O carro tinha sido levado diretamente da pista, sujo e cheio de moscas na frente e no pára-brisa.

Fiquei impressionado com a façanhado Mercedes e o pensamento me ocorreu: como é que um motor turbo do Saab 9000 lidaria comeste tipo de façanha? Nos dois últimos testes de longa duração em Nardò (campo de provas na Itália) o 9000 tinha funcionado sem problemas.

AGENDA: NOVEMBRO 2013

Fotos: Divulgação/ Organização do Evento.

|

| O Encontro Brasileiro de Preservadores de Veículos Militares Antigos promete reunir belas viaturas |

Continuando com nosso espaço dedicado à agenda dos pretendem aproveitar os finais de semana para ver automóveis, o AUTOentusiastas publica aqui algumas idéias e sugestões para aproveitar esse finalzinho de ano. Antes que o clima natalino tome conta espalhando a paz, harmonia e os passeios nos shoppings das cidades, que tal aproveitar novembro para ir de carro aos eventos de veículos?

Os paulistanos que enfrentam batalhas homéricas todos os dias no trânsito bélico da megalópole, podem — ao menos por um momento — esquecer da guerra que é suportar as vias que se transformaram em trincheiras espremidas entre corredores de ônibus, motoboys e ciclistas e admirar veículos de combate nos dias 2 e 3 de novembro, no estacionamento da Assembléia Legislativa, entre Círculo Militar e o Parque do Ibirapuera.

No mesmo domingo, também em território do Exército, os cariocas organizam o Terceiro Encontro de Carros Antigos do Circulo Militar. Já os gaúchos de Carlos Barbosa deixam o espírito separatista de lado e convidam os antigomobilistas a se reunir no 4º Originale.

|

| Terceiro Encontro de Carros Antigos, no Círculo Militar do Rio de Janeiro, RJ. |

|

| A quarta edição do Originale é a exposição que haverá em Carlos Barbosa, RS. |

Friday 25 October 2013

Did We Dodge a Bullet?

Ruggles, Auto Finance News

Or did we just get President Obama’s Second Choice?

Now that Larry Summers has taken himself out of the running for the position of Chairman of the Federal Reserve Bank of the United States, President Obama has appointed the current Fed Vice Chairman, Janet Yellen, to the post. If confirmed, it would make Yellen one of the most powerful woman in the world, with her hands on the controls of the globe’s largest and most powerful economy.

From the Federal Reserve website:

“The Federal Reserve System is the central bank of the United States. It was founded by Congress in 1913 to provide the nation with a safer, more flexible, and more stable monetary and financial system. Over the years, its role in banking and the economy has expanded.

Today, the Federal Reserve's duties fall into four general areas:

- conducting the nation's monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates

- supervising and regulating banking institutions to ensure the safety and soundness of the nation's banking and financial system and to protect the credit rights of consumers

- maintaining the stability of the financial system and containing systemic risk that may arise in financial markets

- providing financial services to depository institutions, the U.S. government, and foreign official institutions, including playing a major role in operating the nation's payments system”

Why might we have “dodged a bullet?” Larry Summers has a LOT of baggage. Many say he is brilliant. According to Car Czar Steve Rattner, “No one is perfect, but I score Larry’s batting average and qualifications at the top of the heap. There’s that extraordinary intelligence: the most brilliant, most analytical and most surgical brain of anyone I’ve ever encountered.”

But Summers laid an egg in his stint as President of Harvard University. He resigned after a “no confidence” vote by the Harvard faculty after he made some less than complimentary statements about women, among other issues. Many think Summers, along with Steve Girsky, engineered the dealer terminations during the GM and Chrysler bankruptcies. In addition, it is well known that Summers participated in the ouster of Brooksley Born, then Chairman of the Commodities and Futures Trading Commission. It seems Summers, Robert Rubin, Clinton era Treasury Secretary, Alan Greenspan, then Fed Chairman, and others didn’t think it was necessary to regulate derivatives, including the credit default swaps which led to the bubble, the mortgage crisis, and the economic collapse of 2008. They thought the derivatives market would “self regulate.” Only the most extreme ideologues still believe that. It was looking like the President was going to have problems from his own party in any Summers confirmation hearings. So Summers withdrew his name from consideration

So what about Janet Yellen? Who better to carry on Ben Bernanke’s policies, which have not been perfect, but have been the best available under the circumstances. After all, the Fed tool box was empty when Bernanke inherited the Great Recession. Interest rates were already so low there was no place to cut them to goose the economy. Congress was handcuffed by obstructionism leaving the Fed with no best choices. We ended up with "quantitative easing," the best of the imperfect choices remaining. The new Fed Chairman will have to navigate difficult waters to ease off the Fed stimulus without cratering the economy or waiting too long, taking the risk fueling rampant inflation. Yellen has been Vice Chairman of the Fed through it all and understands the challenges.

Yellen is immensely qualified. Even though partisanship and obstructionism will make her confirmation an adventure, she is universally respected. She graduated summa cum laude from Brown University with a degree in economics in 1967, and received her PhD. in economics from Yale University in 1971. She has no history to indicate she would be a patsy to Wall Street. Her predictions are the envy of the Fed. She has more Fed experience than anyone in history leading up to her appointment. An added bonus is the fact that she is married to a Nobel winning economist, George Akerlof. Akerlof won his Nobel for his work on “asymmetric information.” As Bill Clinton famously said about his wife Hillary, “You get two for the price of one.”

I think the “second choice” is the “best choice.” Let’s hope Janet Yellen’s confirmation is as smooth as possible so she can get about the business at hand.

RED BULL ESTÁ USANDO CONTROLE DE TRAÇÃO?

CONTINUE LENDO >>>

DE CARRO POR AÍ

Thursday 24 October 2013

O DODGE DART DO MEU PAI

|

| (foto: divulgação da época) |

O Dart era estável. Bom carro. Sólido, robusto. Suspensão firme, bem mais firme que a do Galaxie, seu superior hierárquico na cadeia de status, e até mais firme que a do Opala, seu inferior, mas rodava suave e o motor virava liso, gostoso. E o Dart chegava a ser ágil para o porte; seu belo V-8 de 5.212 cm³ em muito contribuindo para isso, pois a grande potência em baixa o levantava de giro com muita facilidade estivesse lá em que marcha estivesse. As marchas eram poucas e boas: só as tais três mais a ré, alavanca de câmbio na coluna, a ré puxando a alavanca contra uma mola e levando-a para cima; a 1ª mesma coisa só que a alavanca ia para baixo; a 2ª tirando a alavanca da 1ª e soltando-a, no que ia para frente, sua “posição natural” empurrada pela tal mola, depois 2ª para cima e 3ª, para baixo. Para a 3ª marcha entrar bastava embrear e descansar a mão na alavanca quando em 2ª marcha que ela caía naturalmente para 3ª. O Opala e o Galaxie também eram assim, mesma disposição do conhecido "câmbio universal", tal qual a do Jeep Willys e do Ford Modelo A, só que vista por outro ângulo, pela lateral, por ter a alavanca no assoalho.

|

| Como se vê, um carro era uma coisa bem mais simples (foto: divulgação da época) |

Wednesday 23 October 2013

People LOVE Their Car Dealer, But Hate Yours

People carry on a love-hate relationship with car dealers.

They typically love their dealer, as evidenced by rating websites where grateful customers say things like:

- “He cares about his clients and is extremely helpful with any questions or issues.”

- “I have always been extremely pleased with the service and professionalism.”

- “It was honestly the BEST customer service I’ve received in my whole life.”

But many consumers dump on dealers in general. Disliking from afar is a human flaw. Disdaining faceless groups is a building block of bias.

So when the National Automobile Dealers Assn. said the traditional franchised-dealer system actually protects consumers, angry Internet users began pounding their keyboards.

“Yes, everyone I know leaves a dealership thinking, gee, that dealership is really interested in protecting me and my interests rather than their own interests,” one sarcastic wag wrote in the reader comment section of an online story mentioning NADA’s claim.

“Very disappointed to see that NADA thinks we’re a bunch of morons who will buy this line,” someone else commented. “I could respect them more if they would just come out and say they were trying to squash a competing business model.”

Another person proclaimed: “The arrogance of trying to tell us they are just watching out for our best interests is stunning.”

All this bluster is tied to electric-vehicle maker Tesla deciding to short-circuit the conventional dealer system by selling its vehicles directly to customers.

Tesla has opened small showrooms here and there where shoppers can check out the single-product Model S, then order one online from the manufacturer.

Some consumers think that’s the way to go. They see dealers as needless middlemen who hike up vehicle prices, even though one could argue prices would rise if dealers weren’t competing against each other, and a customer instead had to buy a particular vehicle from only one source: an auto maker.

Many foes of the franchise system seem woefully uninformed about how it works. Yet, they praise Tesla founder Elon Musk for trying to “revolutionize” how cars are sold. But auto companies, not dealers, came up with the franchise system.

Auto makers did that because they deemed it better for someone else to sell and service products, especially if that someone covers the facility costs. Accordingly, dealers collectively have invested billions in their stores.

Auto makers realize their core competency is in making vehicles, not selling them. Every now and then, an auto maker will give auto retailing a shot. In the late 1990s, Ford unsuccessfully tried in certain markets, such as Tulsa, OK, and Salt Lake City, UT. It took years for the smoke to clear from that bomb.

A newspaper columnist decries the fact that if you want a Ford, you can’t march down to your local general car store to get one. No, you must buy it from a Ford dealer.

That’s because auto makers want it that way. They don’t want big-box auto stores selling different brands, side by side, under one roof. You’d find plenty of dealers willing to do that, but good luck finding a manufacturer.

Dealer associations and Tesla are battling legally and legislatively over the EV maker’s desire to sell cars directly to consumers. Meanwhile, Tesla stock looks like a bubble ready to burst.

“Elon Musk has done an amazing job of driving up Tesla’s stock price,” Bill Wolters, president of the Texas Automobile Dealers Assn., tells me. “He’s a master of P.R. What puzzles me is that he has never tried the franchise system, yet he insists it won’t work for him.”

Throughout automotive history, start-up companies selling limited-appeal products in unconventional ways have suffered high fatality rates.

I’m not saying the dealership franchise system is perfect or that it will last forever. But I bet it outlives Tesla Motors.

CIDADANIA EMBARCADA

Estamos em 2023. Nossos carros são diferentes do que tínhamos 10 anos atrás. O conceito de transporte que temos no sistema viário contemporâneo é o de direção cooperativa, baseado na capacidade dos automóveis e outros sistemas de transporte se comunicarem com outros veículos e também com os meios de infraestrutura.

Inicialmente esta tecnologia foi puxada pela demanda em aprimoramento de sistemas de segurança, que pretendia fornecer aos viajantes sobre rodas informações suficientes e de maneira antecipada de modo a permitir um planejamento ou reação às diferentes e dinâmicas situações de trânsito.

O conceito evoluiu e passou a comportar outros benefícios, como, por exemplo, o atual sistema de localização, em que de modo síncrono e anônimo os veículos em circulação anunciam a sua posição, oferecendo aos sistemas de controle de trafego condições ideais para temporização de semáforos, abertura ou fechamento de posições em postos de pedágio, capacidade disponível de vagas de estacionamento, ou até mesmo informando ao posto de serviços mais próximo da chegada de um novo cliente necessitando reabastecimento.

|

| Carros em rede |

CONTINUE LENDO >>>