|

| Protect Tapirs: http://www.tapirs.org |

Tapirs are well-camouflaged. So's the taper: you have to look for it. That should not be surprising to anyone who lets their view of the world be affected by data, rather than the pop version of a simplistic model.

...the taper's well-camouflaged...

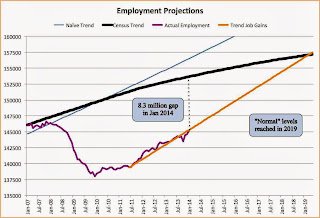

First, the data; I present 1 month, and 1-, 5-, 10- and 30-year interest rates, pulled from the Treasury's Daily Yield Curve web page. Interest rates are certainly up over the nadir of 2012, but casual reading of the graph suggests at best a modest impact (see the Wikipedia entry on the three US rounds of "quantitative easing", or the analysis of economist's such as that of James Bullard at the St. Louis Fed). In the background of course is the continued slow growth of the economy, which at its current pace of job creation will take until 2019 to bring us back to normal. Meanwhile, there are no signs of an uptick in inflation (and in Europe, a few whiffs of deflation).

This is of course in tension with the naive MV = PY monetarist frameword, most clearly developed by Irving Fisher but used as well by JM Keynes and Milton Friedman. In practice, given the ongoing evolution of financial systems around the globe, defining "money" and then measuring it is problematic, and "velocity" is volatile – and QE isn't directly affecting money, only providing an enabler for banks to create additional credit, and thus the bank deposits that we actually use. Meanwhile, at low levels of nominal GDP growth the split between prices and output is sufficiently uncertain that the conceptual link between money growth and prices is empirically useless – if somehow we overcome measurement errors in "M" and can predict V to give us a prediction of the growth of PY – nominal GDP – of 3%, we don't know whether we get real GDP of 3% and no inflation, or 3% inflation and no growth.

So there is no simple link between QE3 and growth. Indeed, there's no simple link with interest rates. At longer maturities interest rates reflect arbitrage opportunities: if we want to hold bonds through (say) 2019 we can for example choose between a 5-year bond and rolling over a series of 1-year bonds. What that tradeoff looks like thus reflects our expectations of future interest rates. If we expect slow growth to continue for most of the next 5 years, then we would expect the Fed to hold short-term interest rates to a low level, with or without QE3 – that is, whether we taper or not. If so, then a 5-year bond should carry an interest rate little different from today's short-term rate. If in 2018 we expect to be back to "normal" with 2% growth and 2% inflation, then we might think that come 2018 one-year rates could be around 4%. In that case 5-year rates (as an average of 1-year rates each year from now to then) would be lower than 4% – using annual rates of .1%, 1%, 2%, 4% and 4% gives a (compounded) 5-year return of 2.2% – but 10-year rates should be sharply higher (assuming rates after 2018 stay a constant 4% gives a 10-year return of 3.1%), and 30-year rates very close to 4% (keeping post-2018 rates at 4% would suggest 3.7%).

...the Fed may taper but interest rate's aren't going to move much...

Now the current rate of employment growth suggests that we won't be back to trend employment levels until 2019. Because of the retirement of the baby boomers employment growth need not be as stront as in the past (a naive projection gives the light blue line, 2.7 million above an estimated based on Census population projections and age-specific employment rates). Unfortunately we're still a long ways from normal. And guess what? My back-of-the-envelope calculations suggests interest rates are consistent with the employment story. The Fed may taper, but absent stronger growth, interest rates aren't going to move much.

...interest rates are consistent with employment growth (or its lack) rather than the taper

Mike Smitka

No comments:

Post a Comment